Compliance, built into the way you work

Whether you're launching a brokerage or scaling a team, Morty makes compliance seamless and scalable — from day one.

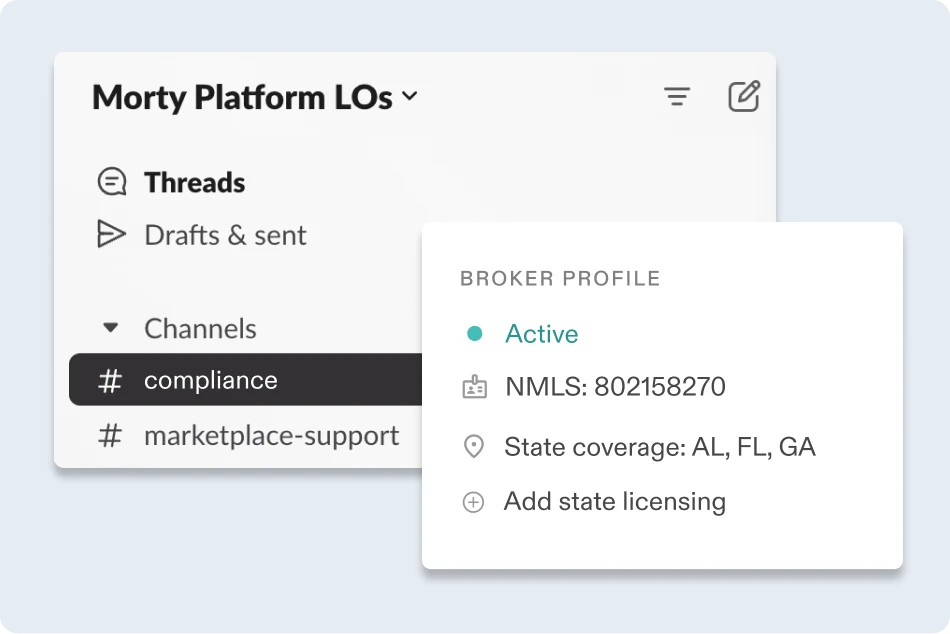

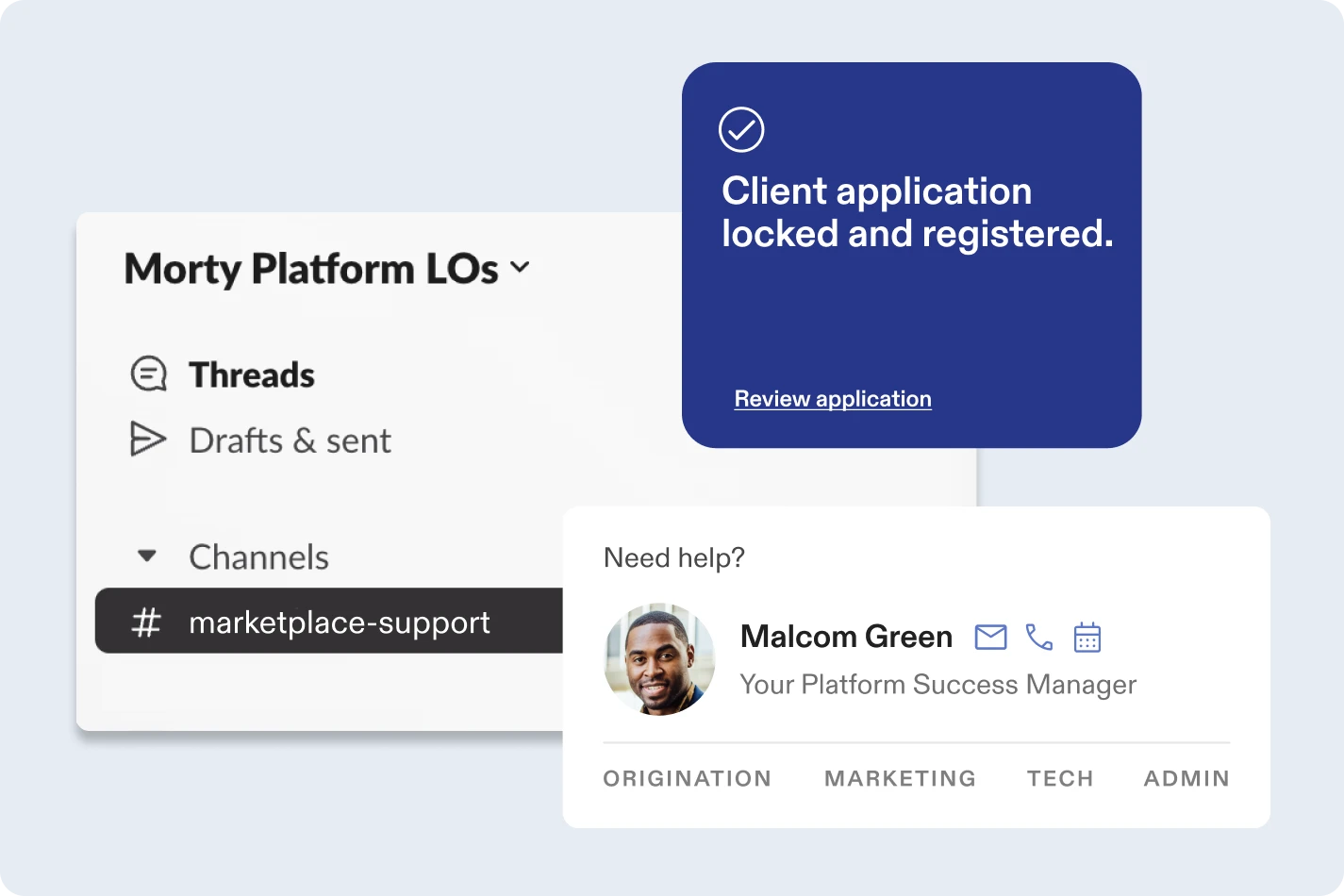

Built-in support for launching and maintaining your brokerage

Compliance infrastructure baked into every workflow

Stay audit-ready with baked-in compliance tools

Explore more of the Morty Platform

- Brand Tools & Marketing Website

- Launch a branded website and leverage marketing templates to grow.

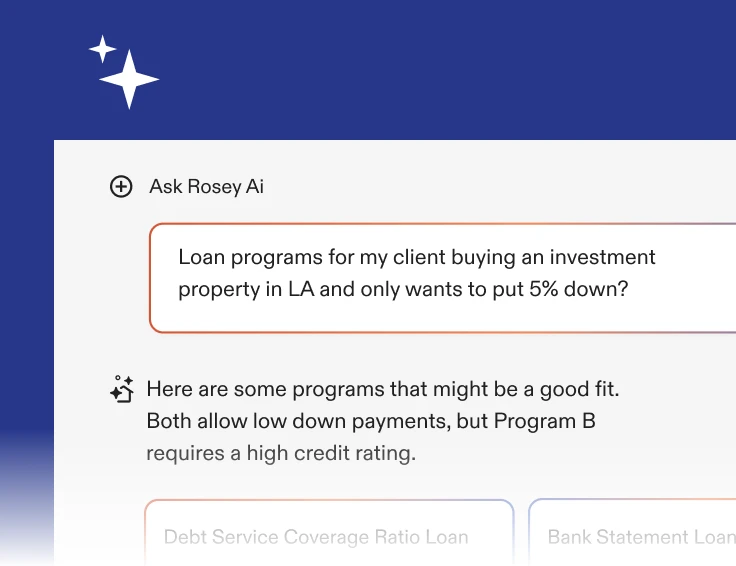

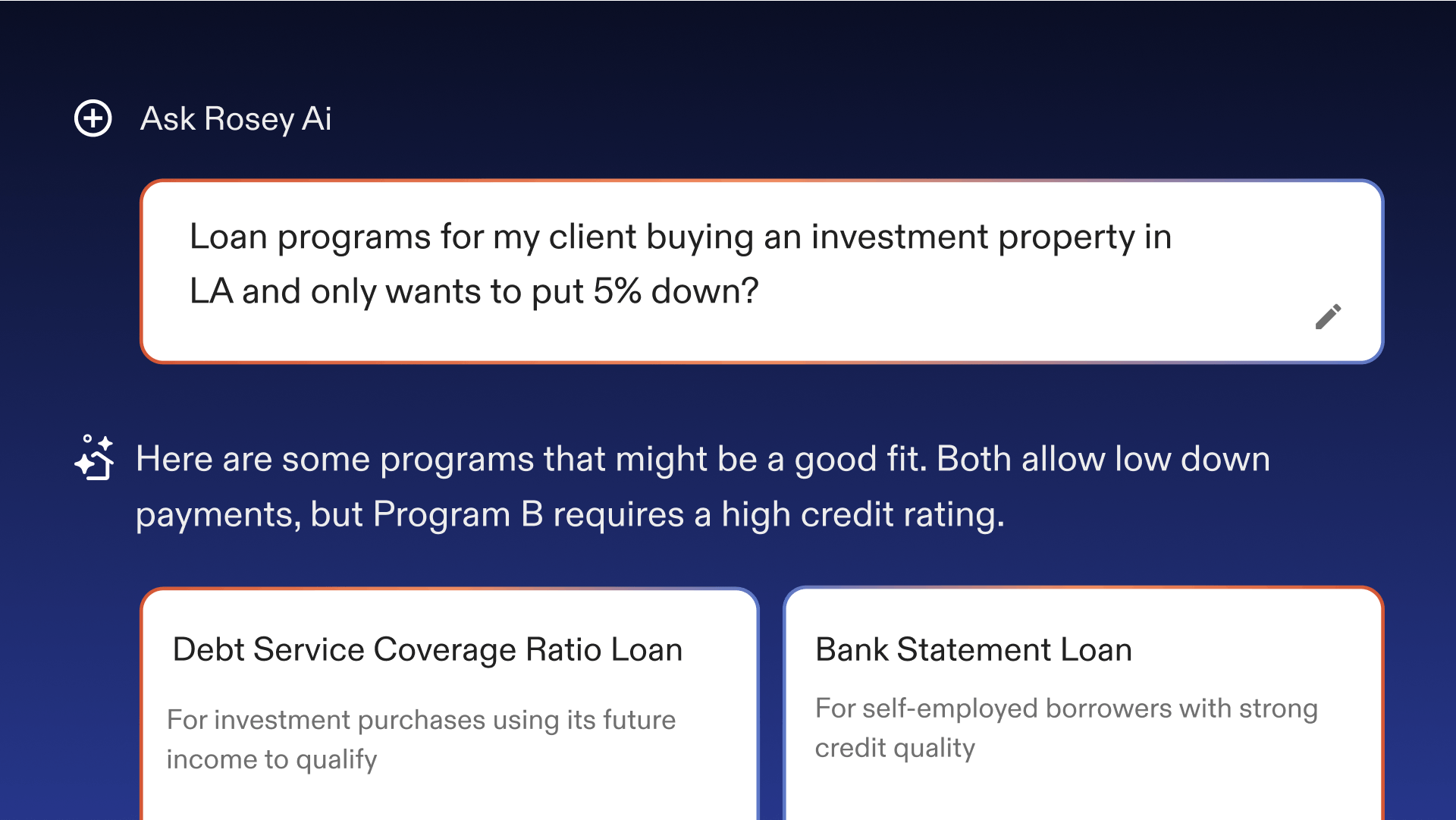

- Rosey AI

- Always-on mortgage AI for loan solutions, doc verification, and speed.

- Loan Origination System

- Manage clients, pipelines, and workflows from a single platform.

“I’m fascinated with Morty. They’ve taken a different approach to the market and having this platform that they’ve built out right now is pretty amazing.”

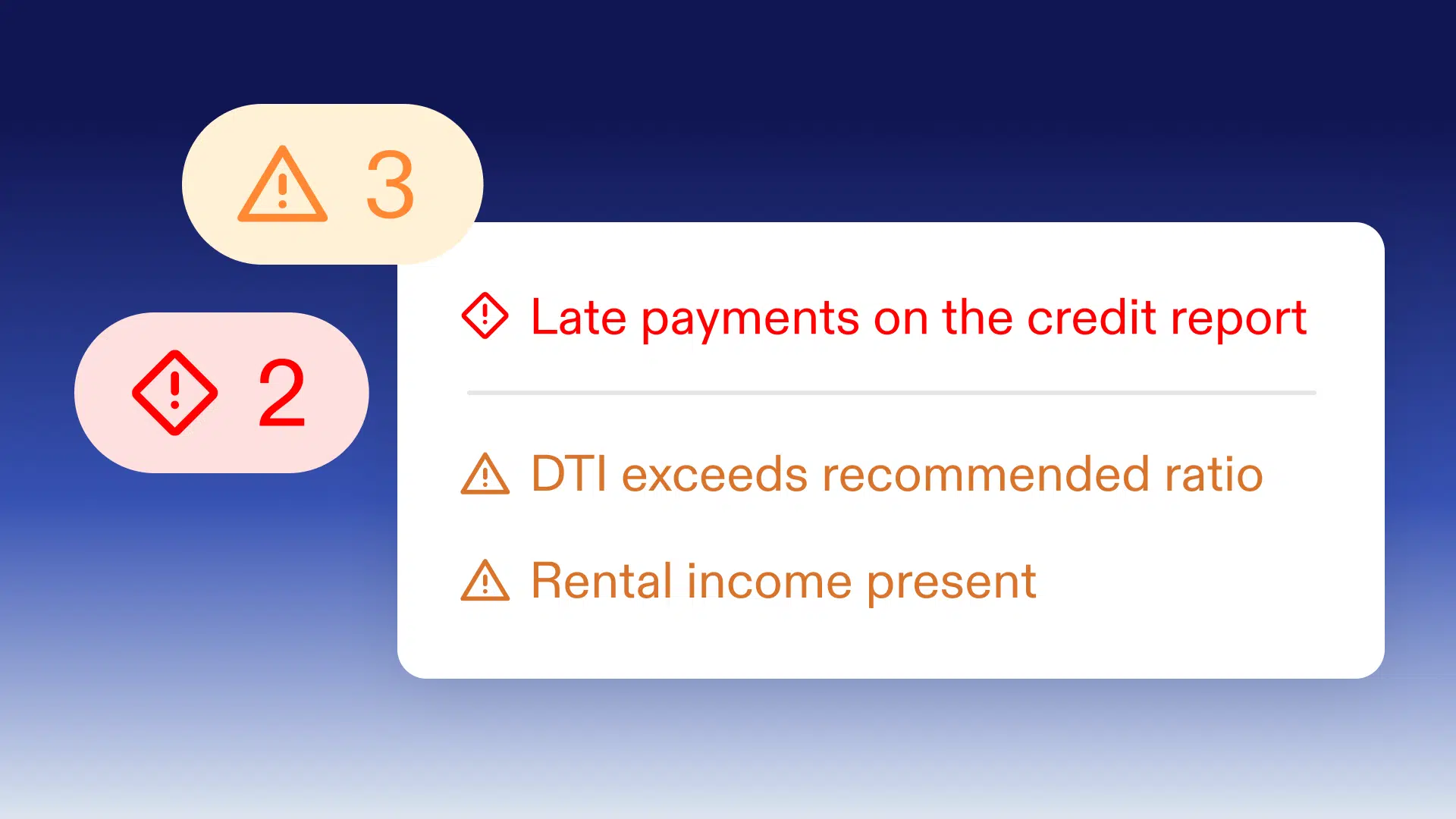

“In finance—whether it’s banking, financial advising, or mortgages—people just need clear explanations. The ability to get quick, accurate insights is critical. A DTI issue shouldn’t take days to figure out—it should take an hour, or even minutes.”

Where others improvise, we’ve built infrastructure

Application Flags for Faster Loan Reviews

Automatically surface missing info and common issues during intake.

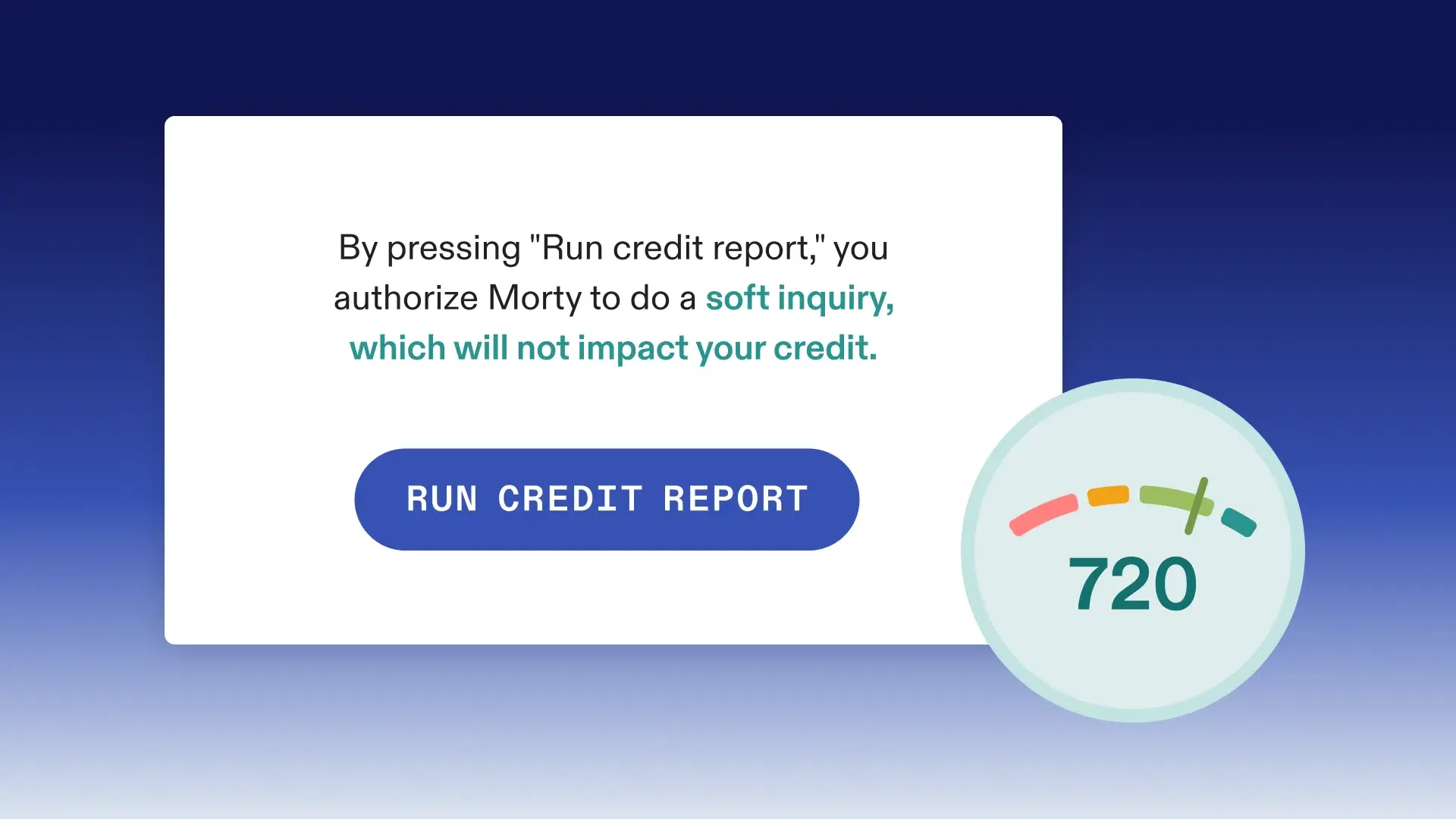

Support for Soft Pulls built into Morty's POS

Enable soft pulls during pre-qual to reduce friction and stay compliant.

Compliant AI Answers at Scale

Give clients clear answers while staying within regulatory lines.